change in net working capital as a percentage of change in sales

Change in Working capital does mean actual change in value year over year ie. Click the answer you think is right Change in profitability Percentage increase in sales Market value of firm Level of net working capital Which one of these terms is the price at which one share of common stock can currently be sold.

How To Run A Profitable Business Profitable Business Small Business Start Up Start Up Business

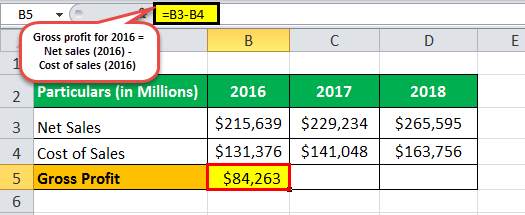

Changes in the Net Working Capital Formula.

. Changes in the Net Working Capital Net Working Capital of the Current Year Net Working Capital of the Previous Year. Percentage of Sales Method Formula Component of Working Capital 100 Sales of the Year. Which one of these questions can be answered by monitoring a firms balance sheets.

Percentage of Sales Method Example. Chipotle Mexican Grills change in working capital for the fiscal year that ended in Dec. Using the same method as quarter one we can calculate net sales and working capital again for quarter 2.

This is why this ratio is also called Working Capital Turnover Ratio as it measures the number of times working capital has been turned over. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow. For example tightening credit reduces sales shrinking.

It means the change in current assets minus the change in current liabilities. 2021 was 215 Mil. For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this.

Changes in Net Working Capital. New number Previous Year Sale. Old Number Current Year Sale.

Use below given data for the calculation. 2021 was 197 Mil. Change in NWC Formula.

First of all we will calculate change in a sale by applying the formula. 2021 was 6525 Mil. Consider following balance sheet for the year 2014 as an example.

Lets understand how to calculate the Changes in the Net Working Capital with the. Compare the ratio against other companies in the same industry for additional insights. There would be no change in working capital but operating cash flow would decrease by 3 billion.

The higher a companys working capital as compared to sales the better off and more stable the company is financially. Imagine if Exxon borrowed an additional 20 billion in long-term debt boosting the current. It is calculated by adding the items under Change in operating assets and liabilities may refer to a different name for different company section in Cash Flow Statement.

In driving Change in NWC impact going forward do you. Working capital 19791 Sales. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital.

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss. Apples change in working capital for the fiscal year that ended in Sep. The formula for the change in net working capital NWC subtracts the current period NWC balance from the prior period NWC balance.

When companies use the same working capital to generate more sales it means that they are using the same funds over and over again. Below are the steps an analyst would take to forecast NWC using a schedule in Excel. B Take change in NWC from 16 to 17 as of sales.

Changes in the Net Working Capital Change in Current Assets Change in the Current Liabilities. Capital dfrac2500019791 126 The quarter 1 ratio is 126. Net sales 23500.

Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital. When sales increase but working capital falls the company may have difficulty sustaining operations and purchasing inventory to fulfill new orders and it may also experience other financial problems. A Take WC as a of sales each year then use the delta of those two numbers for your FCF impact.

Change in Net Working Capital NWC Prior Period NWC Current Period NWC. The formula is working capital divided by gross sales times 100. Apples change in working capital for the quarter that ended in Dec.

Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. Excel-based Investment Research Solution for Serious. The sales for 2014 are 400.

It is calculated by adding the items under Change in operating assets and liabilities may refer to a different name for different company section in Cash Flow Statement. You could allow working capital to decline each year for the next 4 years from 10 to 6 and once this adjustment is made begin estimating the working capital requirement each year as 6 of additional revenues. Setting up a Net Working Capital Schedule.

2021 was -4911 Mil. In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. Chipotle Mexican Grills change in working capital for the quarter that ended in Dec.

Calculation of change in a sale can be done as follows-. Table 1012 provides estimates of the change in non-cash working capital on this firm assuming that. Finance questions and answers.

The higher the sales the more the profits and therefore the more appropriate use of working. For example if working capital amounts to 140000 and gross sales are 950000 working capital. If an operation has revenue of 2000000 then the amount of working capital should be 400000 2000000 x 20 or higher but even more 25-30 of gross revenues would be advised when headed into a period of low income.

Annualized net sales Accounts receivable Inventory - Accounts payable Management should be cognizant of the problems that can arise if it attempts to alter the outcome of this ratio. Change in Net Working Capital is calculated using the formula given below. Working capital as a percent of sales is calculated by dividing working capital by sales.

The Percentage Of Sales Method Formula Example Video Lesson Transcript Study Com

Changes In Net Working Capital All You Need To Know

Trend Analysis Of Financial Statements Accounting For Managers

Profit Margins In The Era Of Unprofitable Tech Platforms Fourweekmba Business Strategy Business Netflix Business Model

Change In Net Working Capital Nwc Formula And Calculator

10 Sample Balance Sheet For Small Business Payment Format Inside Mechanic Job Free Business Card Templates Business Proposal Template Business Plan Template

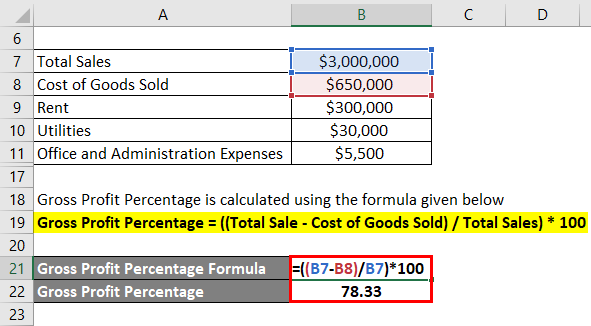

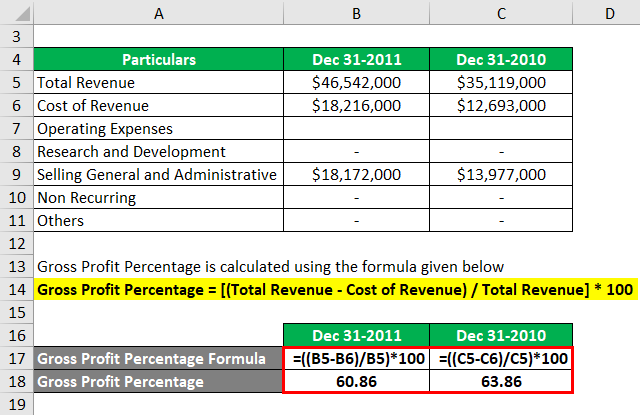

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Types Of Financial Statements Cash Flow Statement Financial Statement Accounting Education

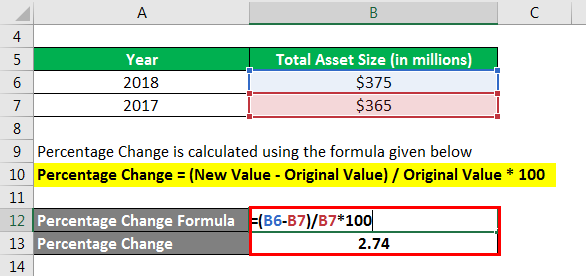

Percentage Change Formula Calculator Example With Excel Template

Percentage Change Formula Calculator Example With Excel Template

Profit Percentage Formula Examples With Excel Template

Percentage Increase And Decrease Calculation And Examples Video Lesson Transcript Study Com

Traditional And Modern Classification Of Accounts An Explanation Of Classification Of Accounts With The Help Of Example Accounting Study Skills Classification

Profit Percentage Formula Examples With Excel Template

Return On Net Worth Ronw Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm M Financial Analysis Finance Investing Bookkeeping And Accounting

Profit Percentage Formula Examples With Excel Template

Vendor Due Diligence Report Template 5 Templates Example Templates Example Report Template Professional Templates Business Template

Working Capital Turnover Ratio Meaning Formula Calculation

In Short Rising Leverage Is One Of Two Traditional Bearish Factors For Credit Markets Leverage Now Looks Set To Government Bonds The Borrowers Credit Market