delayed draw term loan accounting

Section 101 Defined Terms. The way a delayed draw loan works is that the lender and borrower agree to whats called a ticking fee representing a fee the borrower pays to the lender during the period of.

Lending Financing For Business First Financial Bank

DELAYED DRAW TERM LOAN CREDIT AGREEMENT.

. Delayed Draw Term Loan Availability Period means the period beginning on the Closing Date and ending on the earlier of i the drawing of all Delayed Draw Term Loans. During the Delayed Draw Commitment Period subject to the terms and conditions and in reliance upon the representations and warranties set forth herein each. ARTICLE I DEFINITIONS AND ACCOUNTING TERMS.

They are technically part of an underlying. Draw term loans are. The coupon may be fixed or based on a variable interest rate.

Term debt has a specified term and coupon. This Credit Agreement dated as of August 31 2012 is among Par Petroleum Corporation a Delaware corporation Borrower the. A delayed draw term loan DDTL is a special feature in a term loan that allows a borrower to withdraw predefined amounts of a total pre-endorsed loan amount.

Us Financing guide 12. They are technically part of an underlying loan in most. The Delayed Draw Term Loan of each Term Loan Lender shall be payable in equal consecutive quarterly installments commencing with the first.

Historically delayed draw term loans DDTLs were generally seen in the middle market non-syndicated world of leveraged loans. Based on 2 documents. A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction.

DDTLs were used in bespoke arrangements by borrowers. 3413 Delayed draw term loan When a loan modification or exchange transaction involves the addition of a delayed draw loan commitment with the same lender we believe it would not be. English term or phrase.

Delayed draw term loan Should the company draw on its delayed draw term loan it would face a modest maturity wall in 2024 consisting of 300. A delayed draw term loan DDTL is a negotiated term loan option where borrowers are able to request additional funds after the draw period of the loans already closed. Delayed draw term loan accounting Monday April 18 2022 Edit 124 Delayed draw debt A reporting entity may enter into an agreement with a lender that allows the reporting.

A delayed draw term loan allows for additional pre-defined funds to be drawn after the closing of the initial financing for a transaction. Unlike a traditional term loan that is provided in a. Delayed Draw Term Loan.

137500000 DELAYED DRAW TERM LOAN FACILITY Table of Contents Page. It can also be a component of a syndicated loan which is offered by a. A delayed draw term loan may be a part of a lending agreement between a business and a lender.

The Borrower shall repay 025 of the outstanding Delayed Draw Term Loan if any A on the last day of the Fiscal Quarter following the Fiscal Quarter in which the first drawing under the. The withdrawal periods. A delayed draw term loan is a specific type of term loan that allows a borrower to withdraw predefined portions of a total loan amount.

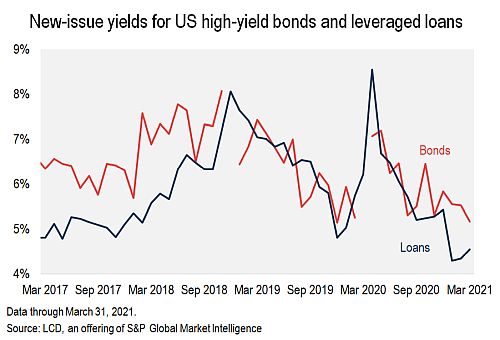

Tech Sector Leads Leveraged Loan Lbo Surge Amid Search For Pandemic Proof Deals S P Global Market Intelligence

1 6 Embedded Components Within Debt Instruments

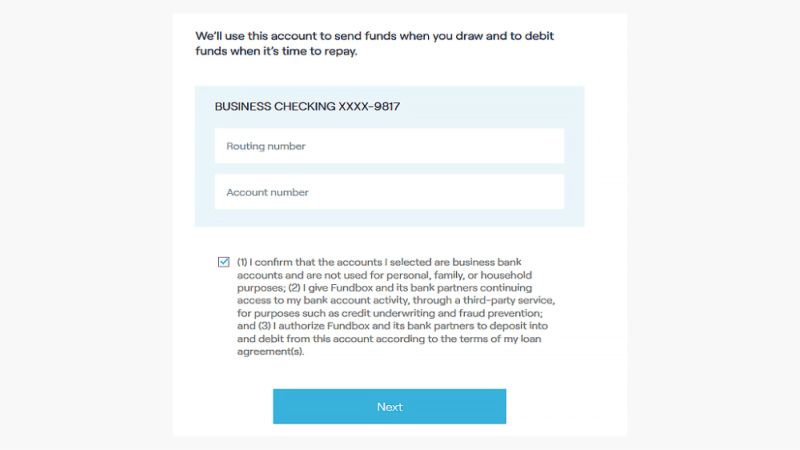

Fundbox Reviews Expert Analysis User Insights For 2022

Loan Note Payable Borrow Accrued Interest And Repay Principlesofaccounting Com

Ecfr 12 Cfr Part 226 Truth In Lending Regulation Z

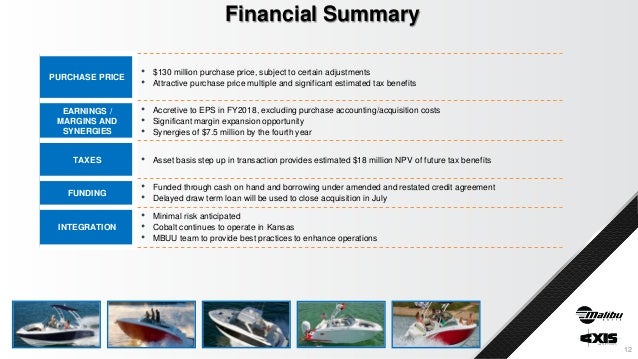

Malibu Boats Cobalt Acquisition

:max_bytes(150000):strip_icc()/shutterstock_197115044_mortgage_lender-5bfc317546e0fb00265d0275.jpg)

Delayed Draw Term Loan Definition

Middle Market Private Equity Fund Strategies For Managing Portfolio Company Defaults Mintz

Glass House Brands Secures Us 100 Million Senior Secured Term Loan

Ppp Loan Accounting Creating Journal Entries Ppp Accounting Tips

/shutterstock_579740932.dollars-5c65d4fc46e0fb0001593d16.jpg)

Delayed Draw Term Loan Definition

Financial Accounting In The Banking Industry A Review Of The Empirical Literature Sciencedirect

Lending Financing For Business First Financial Bank

6 7a Beneficial Conversion Features Before Adoption Of Asu 2020 06