iowa transfer tax calculator

Type your numeric value in the Total Amount Paid field to calculate the total amount due. Tools for estimating Iowa property tax and real estate transfer tax.

Compare Today S Mortgage Rates In Iowa Smartasset

Enter the amount paid in the top box the rest will autopopulate.

. Hamilton County Iowa Real Estate Transfer Tax Calculator Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due. Iowa Real Estate Transfer Tax Calculation This calculation is based on a 160 tax per thousand and the first 500 is exempt. You can also find the total amount paid by entering the revenue tax stamp paid.

Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 500 is exempt. This location is approximately one mile south of Pin Oak Marsh on Highway 14.

Real Estate Transfer Declaration of. Iowa Real Estate Tax tables. This calculation is based on 160 per thousand and the first 500 is exempt.

The tax is imposed on the total amount paid for the property. Calculate the real estate transfer tax by entering the total amount paid for the property. This calculation is based on 160 per thousand and the first 500 is exempt.

You can also find the total amount paid by entering the revenue tax stamp paid. Do not type commas or dollar signs. This calculation is based on 160 per thousand and the first 500 is exempt.

Transfer Tax Calculator Iowa Real Estate Transfer Tax Description. Monroe County Iowa - Real Estate Transfer Tax Calculator. Real Estate Transfer Tax Calculator.

Type your numeric value in the appropriate boxes then click anywhere outside that box or press the Tab Key for the total amount due. Calculating Selling Price of Real Estate Transfer Tax Iowa Real Estate Transfer Tax Rates. To view the Revenue Tax Calculator click here.

Transfer Tax Calculator Recorder Lucas County Iowa. Real Estate Transfer Tax Calculator. This calculation is based on 160 per thousand and the first 500 is exempt.

The Calhoun County Recorders Office is part of the Statewide portal that provides index data for all 99 counties in Iowa. You can also find the total amount paid by entering the revenue tax stamp paid. Total Amount Paid Rounded Up to Nearest 500 Increment Exemption - Taxable Amount Tax Rate.

Iowa Real Estate Transfer Tax Calculator. The Pin Oak Lodge Precinct has been temporarily changed to the R Iowa Barn Precinct. The tax is imposed on the total amount paid for the property.

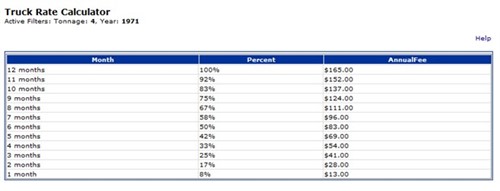

This calculation is based on 160 per thousand and the first 500 is exempt. Labeled Current taxes in the calculator but also for paying the current fiscal years taxes labeled Prorated taxes. Transfer Tax Tables 1991-Present Online Services.

You may calculate real estate transfer tax by entering the total amount paid for the property this calculation is based on 160 per thousand and the first 500 is exempt. Report Fraud Identity Theft. Amount of transfer tax paid divided by rate per 500 A Step 2.

2022 Chickasaw County Iowa. Calculate the real estate transfer tax by entering the total amount paid for the property. You can also find the total amount paid by entering the revenue tax stamp paid.

What is Transfer Tax. You can also find the total amount paid by entering the revenue tax stamp paid. The office collects real estate transfer tax for the Iowa Department of Revenue and collects and reports the County Auditors fee on transfer of property.

The money set aside for taxes is given to the buyer in the form of a. Do not type commas. Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due.

To find out more information Click here. If you are a bank law firm or abstract company interesting in e-filing then we can help. With this calculator you may calculate real estate transfer tax by entering the total amount paid for the property.

Real Estate Transfer Tax Calculator. Dallas County Iowa Courthouse 801 Court Street Rm 203 PO Box 38 Adel IA 50003 Phone. Total Amount Paid Must be 99999999 Rounded Up to Nearest 500 Increment - Exemption.

Real Estate Transfer Tax Table 57-004. Calculate real estate transfer tax by entering the total amount paid for the property or find the total amount paid by entering in the revenue tax stamp paid. This calculation is based on 160 per thousand and the first 500 is exempt.

Multiply A by 500 B Step 3. Do not type commas or dollar signs into number fields. From To Rate June 21 1932 June 30 1940 50 per 500 July 1 1940 June 30 1991 55 per 500 July 1 1991 Present 80 per 500 Step 1.

Real Estate Transfer Tax Calculator. This Calculation is based on 160 per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 500 is exempt.

Calculate the real estate transfer tax by entering the total amount paid for the property. Returns either Total Amount Paid or Amount Due. Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present.

The tax is paid to the county recorder in the county where the real property is located. Iowa Real Estate Transfer Tax Calculator Enter the total amount paid. You may calculate real estate transfer tax by entering the total amount paid for the property.

This calculation is based on 160 per thousand and the first 50000 is exempt. The physical address is R Iowa Barn 44244 State Hwy 14 Chariton. The seller is paying the property taxes for the time lived at the property.

The calculation is based on 160 per thousand with the first 500 being exempt.

Transfer Tax Calculator 2022 For All 50 States

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

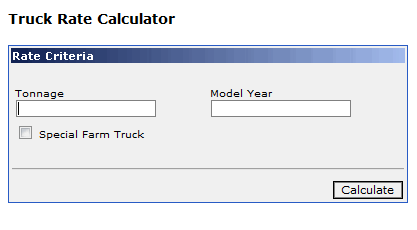

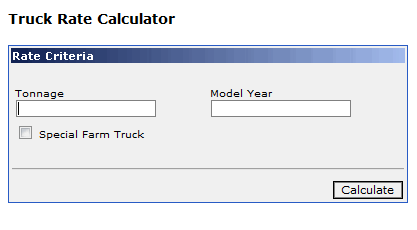

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Transfer Tax In San Diego County California Who Pays What

What You Should Know About Contra Costa County Transfer Tax

Section 16 Standard Deduction Entertainment Allowance Profession Tax

Calculate Your Transfer Fee Credit Iowa Tax And Tags

A Breakdown Of Transfer Tax In Real Estate Upnest

Transfer Tax Alameda County California Who Pays What

Transfer Tax In San Luis Obispo County California Who Pays What

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Tax Title And License Calculator Iowa

Tax Title And License Calculator Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags